Business Insurance in and around Bedford

One of Bedford’s top choices for small business insurance.

No funny business here

This Coverage Is Worth It.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or damage. And you also want to care for any staff and customers who get hurt on your property.

One of Bedford’s top choices for small business insurance.

No funny business here

Insurance Designed For Small Business

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or extra liability, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Jim Groce can also help you file your claim.

Don’t let the unknown about your business stress you out! Contact State Farm agent Jim Groce today, and explore how you can meet your needs with State Farm small business insurance.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

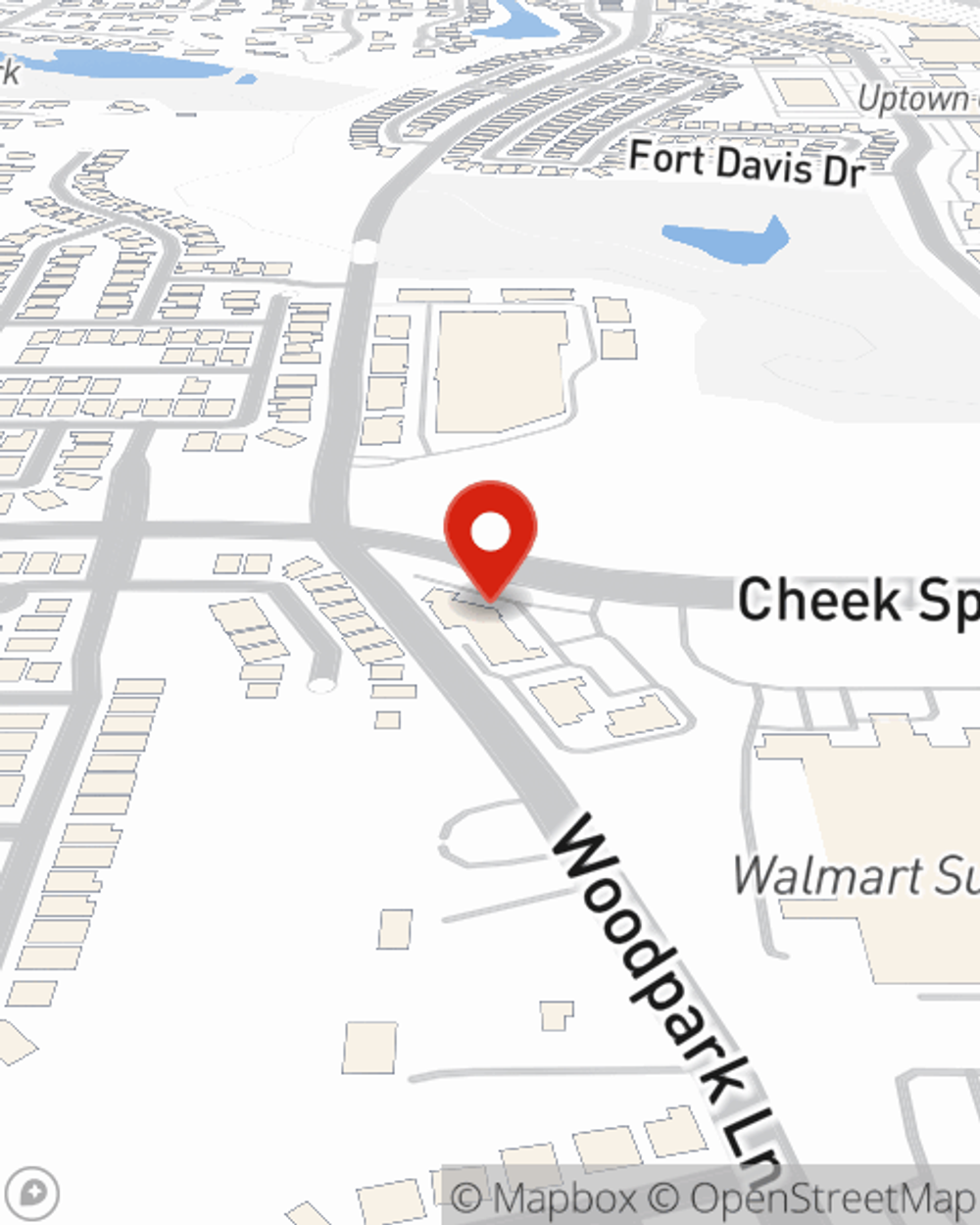

Jim Groce

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.