Life Insurance in and around Bedford

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

It may make you uncomfortable to fixate on when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to your loved ones.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Bedford Chooses Life Insurance From State Farm

Having the right life insurance coverage can help loss be a bit less debilitating for those closest to you and give time to recover. It can also help cover important living expenses like retirement contributions, rent payments and car payments.

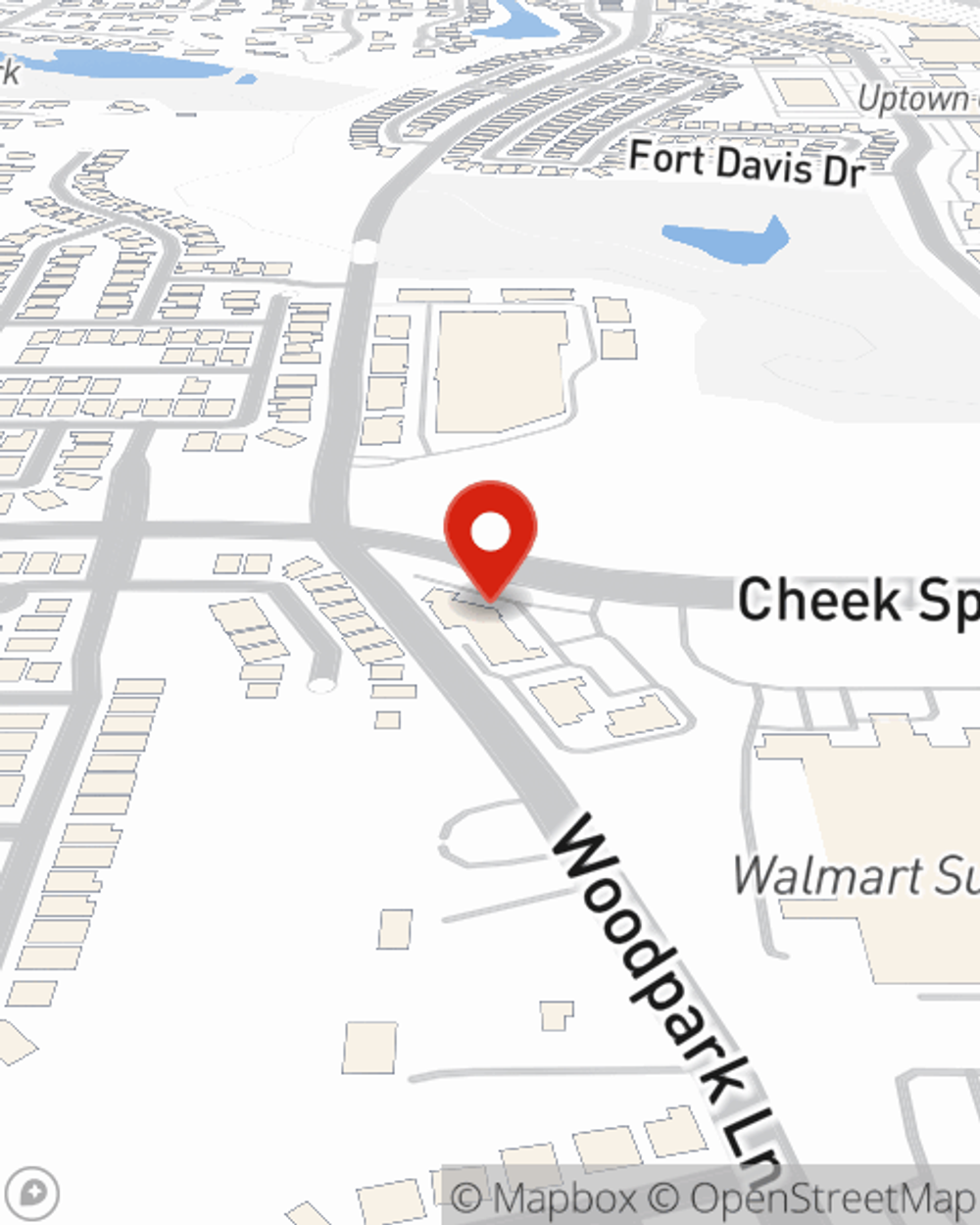

When you and your family are insured by State Farm, you might sleep well at night knowing that even if something bad does happen, your loved ones may be covered. Call or go online today and see how State Farm agent Jim Groce can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Jim at (817) 589-0330 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.